How To Find Variance-covariance Matrix In Excel

Perform calculation of the covariance matrix to determine variances between the returns of different portfolio stocks. Suppose the data matrix and with rows corresponding to subjects and columns are variables.

Covariance Matrix In Excel Step By Step Guide With Examples

The purpose of Covariance is to measure the direction of the relationship whether the relationship is positively correlated x increases when y increases or negatively correlated x decreases when y increases.

How to find variance-covariance matrix in excel. This can be an easy useful way to understand how different variables are related in a dataset. On the top right corner of the data tab click data analysis. Hi board I want to calculate the yearly standard deviation of a portfolio with a few hundred stocks.

Covariance measures the simultaneous variability between the two variablesIt is very useful way to understand how different variables are related. In cell F17 we use COVARIANCES EBAYMSFT. Expected portfolio variance SQRT W T Covariance Matrix W The above equation gives us the standard deviation of a portfolio in other words the risk associated with a portfolio.

Enter the range of the array or matrix as shown in the screenshot. Enter the matrix I into the Excel sheet. To answer the question we need Covariance and Coefficient of Correlation which measure the linear relationship of two variables.

On excel if I divide 46253405 by 335 I get 138070. Lets use the marks of three subjects which is shown below to compute Covariance matrix in excel. Calculate a mean for each variable and replace the data matrix.

Apply the Var function on excel on the returns of the same stock and evaluate if both are matching. You can download the excel sheet used in this chapter. MMultTransposeData Mean Data MeanN where Data is your range of data and Mean is an array of means for each variable.

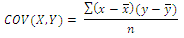

Create a covariance matrix Okay Exercise 2 asks us to create that covariance matrix and for that we will use Excels COVARIANCES function. COVX Y Σx-xy-y n. Using Excels matrix functions we can calculate the covariance function in one swift move with.

I created a new icon for the ribbon. Array1 required argument This is a range or array of integer values. Then if I times 138070 by 335 I get 46253450.

Which is what I need it to be because I need to calculate the difference of a figure not dividing equally. After selecting the required cells enter the MINVERSE function formula into the formula bar. 1 the covariance function in Excel and 2 matrix multiplica.

This shouldnt be necessary as it is quite fast for most datasets. Create a covariance matrix with more than the 73-variable limit that is imposed by the matrix functions more below Calculate the matrix condition number. Click here to load the Analysis ToolPak add-in.

A short video on how to make the variance-covariance matrix in Excel which is a basic skill needed if you are going to optimize portfolios. On my calculator if I divide 46253405 by 335 I get 138070. In the top left cell F16 we calculate the covariance between Microsoft and itself using COVARIANCES MSFTMSFT using those named ranges.

Select the range of cells to position the inverse matrix I -1 on the same sheet. Opens the Data Analysis dialog box and select. For this example the following data including the stock returns are considered.

I plan to first calculate the variance covariance matrix for the portfolios stocks and then use matrix algebra like here. I cover two ways to do it. Then if I times 138070 by 335 I get the SAME result of 46253405.

Calculate the Variance Covariance matrix for the same For a given stock identify the variance value. If you just want. This video covers how to construct the covariance matrix in Excel.

A covariance matrix is a square matrix that shows the covariance between many different variables. In this equation W is the weights that signify the capital allocation and the covariance matrix signifies the interdependence of each stock on the other. Added code so that you can stop the add-in while it is working by pressing the ESC key.

The formula to calculate the covariance between two variables X and Y is. Covariance Formula in Excel COVARIANCEP array1 array2 The COVARIANCEP function uses the following arguments. A positive value of covariance indicates that the two variables move in the same direction whereas a negative value of covariance indicates that the two variables move on the opposite direction.

Select Covariance and click ok. If you cant able to find the Data Analysis button. The diagonal elements of this matrix are the variances of the variables and the off-diagonal elements are the covariances between the variables.

Calculating Covariance Matrix Using Excel Youtube

Risk Part 3 Variance Covariance Matrix Varsity By Zerodha

Calculating Value At Risk In Excel Without Vcv Matrix

Variance Covariance Matrix Using Excel Data Analysis الحسابات اليدوية لمصفوفة التباين والتغايير Youtube

Risk Part 3 Variance Covariance Matrix Varsity By Zerodha

Calculating The Variance Covariance Matrix Using Stock Prices Youtube

Risk Part 3 Variance Covariance Matrix Varsity By Zerodha

How To Create A Covariance Matrix In Excel Statology

Special Topics The Kalman Filter 23 Of 55 Finding The Covariance Matrix Numerical Example Youtube

Modeling Portfolio Variance In Excel

Create Covariance Matrix In Excel Or Covariance Table In Excel Datascience Made Simple

Risk Part 3 Variance Covariance Matrix Varsity By Zerodha

Risk Part 3 Variance Covariance Matrix Varsity By Zerodha

Vid2 1 Covariance And Portfolio Variance Using Matrix Youtube

Excel Covariance Matrix With N A Data Stack Overflow

Covariance Matrix In Excel Step By Step Guide With Examples

Calculating The Variance Covariance Matrix Using Stock Prices Youtube

Calculating Portfolio Variance Using Variance Covariance Matrix In Excel Risk Contribution Youtube

Update To Variance Covariance Matrix Builder For Excel 2010 And 2013 Tvmcalcs Com